Use one of our templates to list the sales, expenses, and other gains or losses in the correct format. At the bottom of the statement, compute the net income for the company. This net income calculation can be transferred to Paul’sstatement of owner’s equityfor preparation. They use competitors’ P&L to gauge how well other companies are doing in their space and whether or not they should enter new markets and try to compete with other companies.

- The period of time that is covered by the income statement is called theaccounting period.

- You can use cash-basis, accrual, or modified cash-basis accounting to manage your books.

- It has a predefined purpose and a limited scope in terms of activity and is sometimes used as a short term solution to a current or potential problem.

- Under the accrual basis of accounting, revenues are recognized when earned.

- And sometimes, it can be like pulling teeth to get customers to pay you on time.

- Modified cash-basis accounting is a mixture of both cash-basis and accrual accounting.

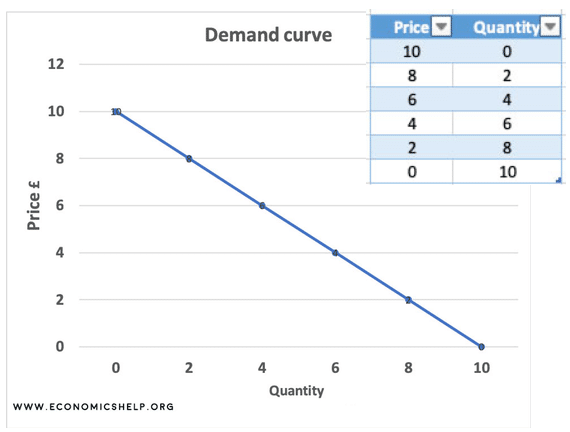

B) The income statement may be drawn up for shorter periods, such as one month or three months. C) These shorter periods are used by managers to make internal business decisions. D) The period of time that is covered by the income statement is called the accounting period. The income statement is a report showing theprofit or lossfor a business during a period, as well as theincomesandexpensesthat resulted in this overall profit or loss.

Beginning-of-period cash balance plus change in cash allows you to arrive at end-of-period cash balance. Take a couple of seconds to plan your answer and repeat the question back to the interviewer out loud . P&L expenses can also be formatted by the nature and the function of the expense. Are you a new small business owner looking https://accountingcoaching.online/ to understand your tax return a little more? Here are the definitions of various types of income and how they related to your small business’s taxes. The statements and opinions are the expression of the author, not LegalZoom, and have not been evaluated by LegalZoom for accuracy, completeness, or changes in the law.

Top Income Statement Questions

Do you know what your gross profit margin is and what it means for your bottom line? If you are like many business owners, you have a basic understanding of your financial statements but leave the heavy lifting to your bookkeeper and accountant. The current ratio is calculated as current assets/current liabilities. We use the same amounts that we used in the working capital calculation, but this time we divide the amounts rather than subtract the amounts. This means that for every dollar of current liabilities, Cheesy Chuck’s has $3.35 of current assets.

While a trial balance is not a financial statement, this internal report is a useful tool for business owners. It is also used at audit time to see the impact of proposed audit adjustments. Whether you’re looking for investors for your business or want to apply for credit, you’ll find that producing four types of financial statements can help you.

You should always obtain independent, professional accounting, tax, financial, and legal advice before engaging in any transaction. The format is similar to the format of the income statement . The heading of the income statement includes three lines.The first line lists the business name. Assume that as part of your summer job with Cheesy Chuck’s, the owner—you guessed it, Chuck—has asked you to take over for a former employee who graduated college and will be taking an accounting job in New York City. In addition to your duties involving making and selling popcorn at Cheesy Chuck’s, part of your responsibility will be doing the accounting for the business. The owner, Chuck, heard that you are studying accounting and could really use the help, because he spends most of his time developing new popcorn flavors.

- Subtract the selling and administrative expenses total from the gross margin.

- Download this guide and learn tips on how to launch your site, master inventory management, and more.

- Which reporting period is right for you depends on your goals.

- Are you a new small business owner looking to understand your tax return a little more?

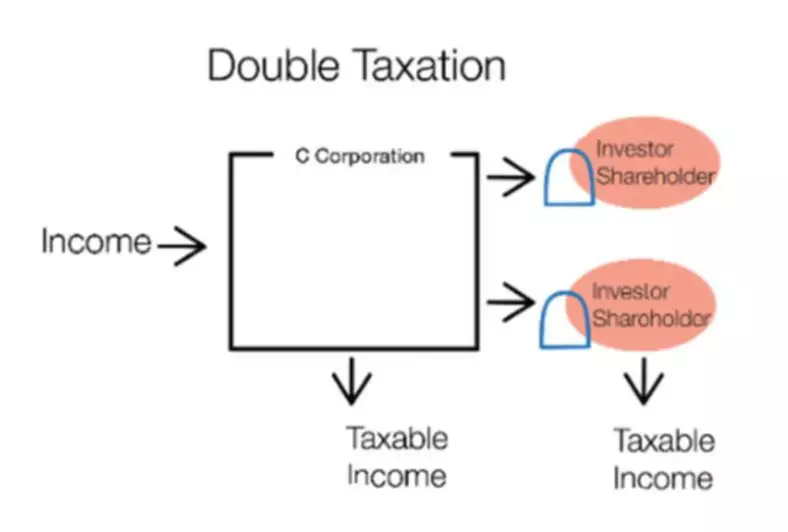

- However, later we switch the structure of the business to a corporation, and instead of owner’s equity, we begin using such account titles as common stock and retained earnings to represent the owner’s interests.

EV/EBITThe EV to EBIT ratio is an important valuation metric that determines whether a company’s stock is expensive or cheap in comparison to the broader market or a competitor. After conversion, increases the earnings for the common shareholders of the company. Cash Flow Statement, assuming that only cash has been paid by the company to purchase the equipment. The Cash Flow from Investing will result in the cash outflow of $5million. Cash Flow StatementA Statement of Cash Flow is an accounting document that tracks the incoming and outgoing cash and cash equivalents from a business.

Finance Interview Questions

Are you a CFA Level I candidate, or someone who is exploring taking the CFA exam? I am a Computer Engineering graduate and have been working as an engineer all my life. Having developed a keen interest in finance, I decided on a career switch to the finance field and enrolled into the CFA program at the same time. Each option is convertible into 1 common share at $20 exercise price. How much profit can the shipbuilder book for the contract in the first year?

Budgeted income statements can also be drawn up, showing targeted figures for sales, expenses and profits. The period of time that is covered by the income statement is called theaccounting period.

It can also be referred to as a profit or loss account, and is a crucial financial statement that shows the businesses income and expenditures, detailing your net income or net profits. It shows the company’s revenues and expenses during a particular period, which can be selected according to the company’s needs.

Final Accounts 1: The Income Statement 1

Operating expenses are the expenses your business incurs to keep it running, such as wages, rent, office supplies, and more. Operating expenses might be lumped into one section along with cost of goods sold if you use a single-step income statement. However, most businesses use the multi-step income statement format, which shows operating expenses broken out into multiple line items for different types of expenses. You may want to group certain operating expenses on one line for simplicity’s sake. For example, your electric, gas, and sewer utility expense can be grouped as “Utilities.“ This keeps your income statement from becoming too unwieldy. An income statement is a financial statement that shows your revenue after expenses for a particular period, such as a month, quarter, or year.

In the example to follow, for instance, we use Lease payments of $24,000, which represents lease payments for the building ($20,000) and equipment ($4,000). In practice, when companies lease items, the accountants must determine, based on accounting rules, whether or not the business “owns” the item. If it is determined the business “owns” the building or equipment, the item is listed on the balance Income Statement Q&A sheet at the original cost. Accountants also take into account the building or equipment’s value when the item is worn out. The difference in these two values will be allocated over a relevant period of time. As an example, assume a business purchased equipment for $18,000 and the equipment will be worth $2,000 after four years, giving an estimated decline in value of $16,000 ($18,000 − $2,000).

Frequently Asked Questions

The non-operating section includes other income or expenses like interest or insurance proceeds. As you can see, this example income statement is a single-step statement because it only lists expenses in one main category. Although this statement might not be extremely useful for investors looking for detailed information, it does accurately calculate the net income for the year. In the end, the main purpose of all profit and loss statements is to communicate the profitability and business activities of the company with end users. Each one of these end users has their own use for this information. Your choice of format depends on what you intend to use your income statement for, and what level of financial detail you’re intending to provide.

- A Cash Flow statement is a Financial Statement that shows a company’s cash inflows and outflows over a specific period.

- For instance, the purchase of land and joint venture investment is cash outflow, while equipment sale is a cash inflow.

- These are the inflows to the business, and because the inflows relate to the primary purpose of the business , we classify those items as Revenues, Sales, or Fees Earned.

- The number one thing to know when preparing an income statement is that it is drawn up from the figures in the trial balance.

- Notice the amount of Miscellaneous Expense ($300) is formatted with a single underline to indicate that a subtotal will follow.

- Expenses—costs of providing the goods or services for which the organization earns revenue.

Depreciation Expense and Bad Debts Expense are examples of expenses that are estimates.

However, the income statement may be drawn up for shorter periods, such as one month or three months . These shorter periods are used where the business managers and employees want to analyze the performance of the business over a shorter time period to help make internal business decisions. Theincome statementis the first component of ourfinancial statements. This question helps an interviewer assess whether you have experience and skills making presentations. Some financial analysts are regularly tasked with presenting data to company leadership or other parties, so hearing how you’ve done in the past will help them predict how you’d do in the role you’re applying for. The company wants to know why you want to work for them specifically—in this industry, for this type of organization, and at this particular company.

What’s The Easiest Way To Prepare An Income Statement?

Walk the recruiter through your thought process in choosing the metric you prefer and talk about what it can tell you about the stock and how that would help you evaluate a company. You can also mention other metrics in your answer to help you explain why the one you chose is better or what secondary metrics you’d pick if you could add others to support your primary choice. If you’re an entry-level candidate, don’t panic if you don’t already have these. In this case, the interviewer probably wants to hear that you’ve given this career path long-term consideration. So if you’re planning to pursue a certification or have already begun to take steps toward one, talk about why you decided to do so and how you plan to achieve this goal. Organizations are trying to see how dedicated you are to furthering your education and skills, what you’ve gotten from your education, and how you apply it.

That information can help you make business decisions to make your company more efficient and profitable. Income statements depict a company’s financial performance over a reporting period. Another way to think of the connection between the income statement and balance sheet (which is aided by the statement of owner’s equity) is by using a sports analogy. The income statement summarizes the financial performance of the business for a given period of time. The income statement reports how the business performed financially each month—the firm earned either net income or net loss. This is similar to the outcome of a particular game—the team either won or lost.

Finance Interview Questions To Prepare For

Our first step is to determine the value of goods and services that the organization sold or provided for a given period of time. These are the inflows to the business, and because the inflows relate to the primary purpose of the business , we classify those items as Revenues, Sales, or Fees Earned. The revenue for Cheesy Chuck’s for the month of June is $85,000. In a financial report, accounting information is presented in the form of financial statements packaged with other information, such as explanatory footnotes and a letter from top management.

In Why It Matters, we pointed out that accounting information from the financial statements can be useful to business owners. The financial statements provide feedback to the owners regarding the financial performance and financial position of the business, helping the owners to make decisions about the business. We’ve compiled a list of the most common and frequently asked finance interview questions. If you want to ace your finance interview, then make sure you master the answers to these challenging questions below. This guide is perfect for anyone interviewing for a financial analyst job, and it’s based on real questions asked at global investment banks to make hiring decisions. Types Of Financial StatementsThere are three types of financial statements, i.e., Balance Sheet, Income Statement and Cash Flow Statements.

“There are no right or wrong answers—some companies value independence and some value working in teams,” Jaffee says. The key is to find the one that matches with your own preferences. Expect to get this question for any entry-level financial analyst role.

A rights offering is an issue that is offered to the existing shareholders of the company only and at a predetermined price. Stock DividendA stock dividend refers to bonus shares paid to shareholders instead of cash. Companies resort to such dividends when there is a cash crunch.

Generate A Trial Balance Report

This is the beginning of the process to create the financial statements. It is important to note that financial statements are discussed in the order in which the statements are presented.

Go into your accounting software and print a trial balance for the period end. The trial balance is a summary report that contains ending balances for every account in the general ledger. Although the income statement is typically generated by a member of the accounting department at large organizations, knowing how to compile one is beneficial to a range of professionals.

One needs to dig deeper as to why the company needs to raise the capital. Special Purpose EntityA special-purpose entity is created to fulfill particular objectives, including devising measures to appropriate financial and legal risk profiles.

Section 102 Item 10e Of Regulation S

I hope you enjoyed this article and found these finance interview questions hepful. Please feel free to add any comments or recommendations in the comments section below. Differences in revenue recognition, expense recognition , and net operating losses can create deferred tax assets. Mention repurchase/issuance of debt and equity and paying out dividends to arrive at cash flow from financing activities.