Contents

To understand more about value investing, our team at takethiscourse.net has compiled a list of 11 Best Value Investing Courses & Training Classes. With the help of this list of value investing courses, you can find a suitable course for yourself and start learning the art of value investing today. You can learn the fundamentals of value investing and how to identify inexpensive stocks from these courses. I have no prior experience in investing or value investing other than the index funds offered by my employer. Especially useful were the real life examples of various stocks and the stories behind their rise/fall etc. This program is suitable for attendees at all executive levels who want to refine their understanding of value-based investing principles for professional and personal use.

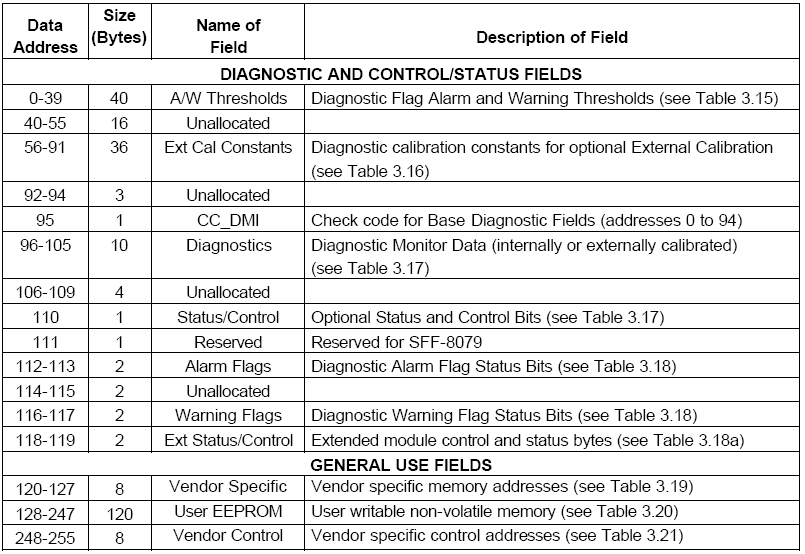

It provides a list of multiple courses, specializations, and master programs in value investment. However, the highest-rated courses are Bonds & Stocks, Foundational Finance for Decision Making, Understanding Financial Markets, and Corporate Financial Assets. What’s more interesting is that whatever course you opt for, you will get continuous support from the instructors to help you resolve your queries and provide additional assistance for learning.

You’ll understand how to estimate an organization’s asset value, earning power value, and marginal ROIC. P.P.SI’m so confident this course will have a profound impact on your returns, that if it doesn’t, let me know and I’ll give you back your money, no questions asked. You can also ask any questions you may have in The Value Investing Society Facebook group, to which you will get access after your purchase. This course takes you from a beginner without a strategy to a confident value investing expert.

The program’s Faculty Director Tano Santos

Select stocks based on how business, industry, and economic factors affect the modern valuation protocol. „Nick did a great job of presenting his course in small bite size videos that are easy to digest. I thoroughly enjoyed and would recommend it to others who are thinking of managing their own portfolio of stocks.“ This course is intended for all those who wish to learn to evaluate the management of the business you wish to invest in. The best thing about this course is its focus on explaining how you can get an investment framework to evaluate any kind of stock idea. In order to help our readers in taking a knowledgeable learning decision, TakeThisCourse.net has introduced a metric to measure the effectiveness of an online course. For $129, you can choose either the self-paced course or the instructor-led course taught by Yale alum Matt Crabtree.

The course is comprised of more than 46 lectures divided into six sections, includes a quiz, and the content has many charts and graphs to help you understand. The Warrior Pro, their most popular offering, is available at $4,297 (90-day access) or $5,997 (one-year access) and has the aforementioned features and course of the starter pack, plus many additional courses. They are small and large cap day trading, swing and options trading, and day trading in an IRA.

Similarly, if you want to https://business-oppurtunities.com/ all about how to do financial statement analysis, then Udemy has a course for that too. Therefore, whatever the course you need is relevant to value investing, Udemy has it for you. The investing courses below are affordably priced and accessible even to beginning investors who may not have much prior knowledge. These courses provide a comprehensive learning experience and introduce students to all aspects of investing. They also feature supportive communities of instructors and peers, along with plenty of additional resources for further learning. Value investing is the powerful investing strategy that the greatest investors of our time, like Warren Buffett, Charlie Munger and Seth Klarman, use to earn billions on the stock market.

Beyond that, the analytical approach teaches critical thinking about growth and profitability, valuable for all corporate decision makers. Understanding the valuation of a company gave me a different perspective on investments in stocks and how a different perspective can help my strategy. Reading and analyzing qualitative points of view makes me understand the quantitative better. I enjoyed learning about franchise value and understanding a little bit more about barriers to entry. But beyond that, the analytical approach teaches critical thinking about growth and profitability, which is valuable for all corporate decision makers.

Value Investing Courses (Coursera)

Successful completion of this program fulfills two curriculum days towards the UC Berkeley Certificate of Business Excellence . Compare two retailers in the same industry and how their relative business strategies might influence their profitability. Send an email to and your money will be refunded immediately, no questions asked. Early on in my investment career, I lost half my savings in one week, because I had no idea what I was doing. To determine the best value, we also considered the price and what sort of course options were available for users, especially in terms of continued access and resources.

Your A-game is the best technical performance you are capable of based on your knowledge. A practical overview of how to identify superior companies that can be very successful long-term investments. The relatively recent examples used in the book make it a helpful modern work for someone interested in learning how to practice the Phil Fisher-style of intrinsic value investing. By taking this online investment training you’ll learn the skills that will enable you to see remarkable improvements in how competitive you are in the finance industry as a financial analyst or as an investor.

- The investing courses below are affordably priced and accessible even to beginning investors who may not have much prior knowledge.

- This course teaches you everything you need to know about value investing, starting with the fundamentals and moving up to the most complex ideas.

- Upon successful completion of the program, UC Berkeley Executive Education grants a verified digital certificate of completion to participants.

The value investing course will help you live a better financial life without getting into any financial troubles. It will help you learn how you can make valuable investment decisions without external help and earn 15-20% annual returns on your investments. You don’t need any prior experience to learn these skills, you just need to learn through the course to understand how Value Investment strategy works and how to adopt this strategy to earn profits. The course is offered by Wealthy Education, that has a team of experienced trainers and instructors who will help you during the course. You may also want to have a look at a compilation of best technical analysis courses on our website.

+ BONUS: Access To The EXCLUSIVE Value Investing Society Facebook Group…

An excellent overview on how to think about building your idea generation process. An in-depth description of the first part of Buffett’s investment journey from a Graham-style value investor closer toward a Phil Fisher-style value investor. While the Buffett Partnership letters are not officially available, clicking on the link above will bring you to search results where you will likely be able to find several compilations. On the other side of the intrinsic value investing continuum from Graham’s Security Analysis, Fisher teaches us the value of intangibles and the dynamic nature of business value.

We have understood the importance of Value Investing Course and Value Investing in Singapore and other parts of the world. Our ultimate goal is to ensure regular folks like you can achieve financial freedom. We share and publish personal finance and stocks investing knowledge through our online community, learning platforms and ‘live’ events. Most of you might not be aware of this platform, as it is an initiative by Vishal Khandelwal to help investors become smart, independent, and successful in the stock market investment decisions.

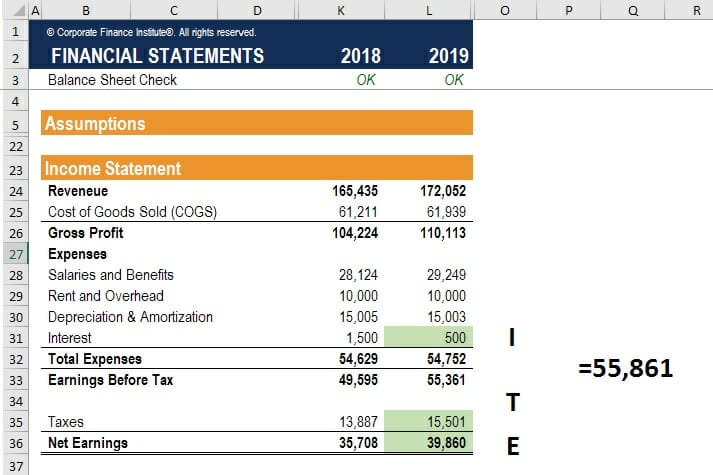

Value 7 step strategy – internet home business success is looking for companies that are listed for sale, while growth investing is looking for companies that are growing much faster than most other companies. Value investors will consider investing in a company whose price is equal to or lower than its intrinsic value. It’s not possible to look into your neighbor’s checkbook, but companies have to publicly disclose all the money they earn and spend in their financial statements. These statements offer you a peek into the kitchen and allow you to identify the financially strong companies value investors love so much. Knowing how to determine the true value of a business is key, because when you know what a company is worth you canspot over- and undervaluation and earn higher returns at a lower risk! Getting more than what you pay for is what value investing is all about…

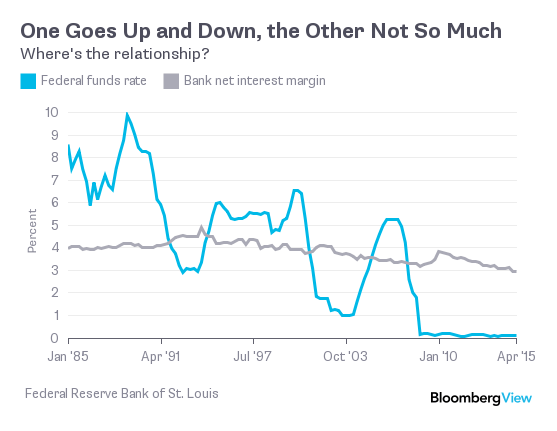

A first interest is the field of asset pricing with a particular emphasis on theoretical and empirical models that can account for the predictability of returns, both in the time series and the cross section. A second interest of Professor Santos is applied economic theory, specifically, the economics of financial innovations as well as the theory of organizations. Participants will need the latest version of their preferred browser to access the learning platform. In addition, Microsoft Office and a PDF viewer are required to access documents, spreadsheets, presentations, PDF files, and transcripts.

Coursera

A key strength of our program is its intensive focus on real-world experience and our collaboration with leading firms and practitioners. These range from program alumni to highly successful investors who have much practical insight to share with our students. Students who complete the concentration will be well-prepared for a wide range of careers in which they will need to assess investment opportunities, as evidenced by the superior job placements of recent graduates. Stanford University is one of the leading universities in the world that also run various online platforms to help individuals get the best education. These Value Investment courses are also offered by Stanford University to help you learn every concept of Value Investment from beginning to advanced.

The components that helped me to earn passive income are the VIA Funnel, that helped me to screen companies… and options strategy classes that helped me sell options to earn premiums consistently. This year’s newsletter highlights program alumni, includes interviews with guest lecturers, and spotlights the important contributions of our program co-founder Humberto Merino-Hernandez. Senior-level professionals who want to understand the ideation methods and drive tech investments in their organization can also take this program. „Nicely consolidated information and lessons from the best investors. Easy to follow and good examples for explaining concepts. Nick also provides a lot of valuable resources. Top notch course.“ The reason why we chose this course is its focus on explaining all about the financial statement analysis and how you can balance your cash flows, balance sheet, and evaluate your company’s profits and revenue.

You can also take your learning on the go with the TD Ameritrade mobile app. Whether you’re an investment newbie or a seasoned investment professional, there is something in TD’s content library for everyone. This course will teach you how value investing works and its fundamental principles, like ‘intrinsic value’, ‘Mr Market’ and ‘margin of safety’.

In-person, blended, and online courses

Panos’ work focuses on interdisciplinary capital markets research and informs „micro-to-macro“ and „macro-to-micro“ questions bridging the gap between academics and practitioners. Panos’ research interests overlap with his teaching and his MBA course on Financial Information Analysis has proven to be an invaluable source of research ideas. When evaluating an investment opportunity you need to understand a company’s past performance and future potential. Learn to interpret financial reports and forecasts using professional investors‘ analysis techniques. We recommend Udemy’s Stock Market From Scratch for Complete Beginners as the best overall course for its affordability and approachability.